Dear Investors,

In the current scenario First & Foremost thing is to SAVE YOURSELF.

Once You have done this YOU can think to SAVE FOR YOURSELF as equity markets are providing such a tremendous opportunity to buy good companies at very discounted rates.

The only panic which comes into mind is how long it (Corona) will exist & Consequences of it on the Global and Indian Economy.

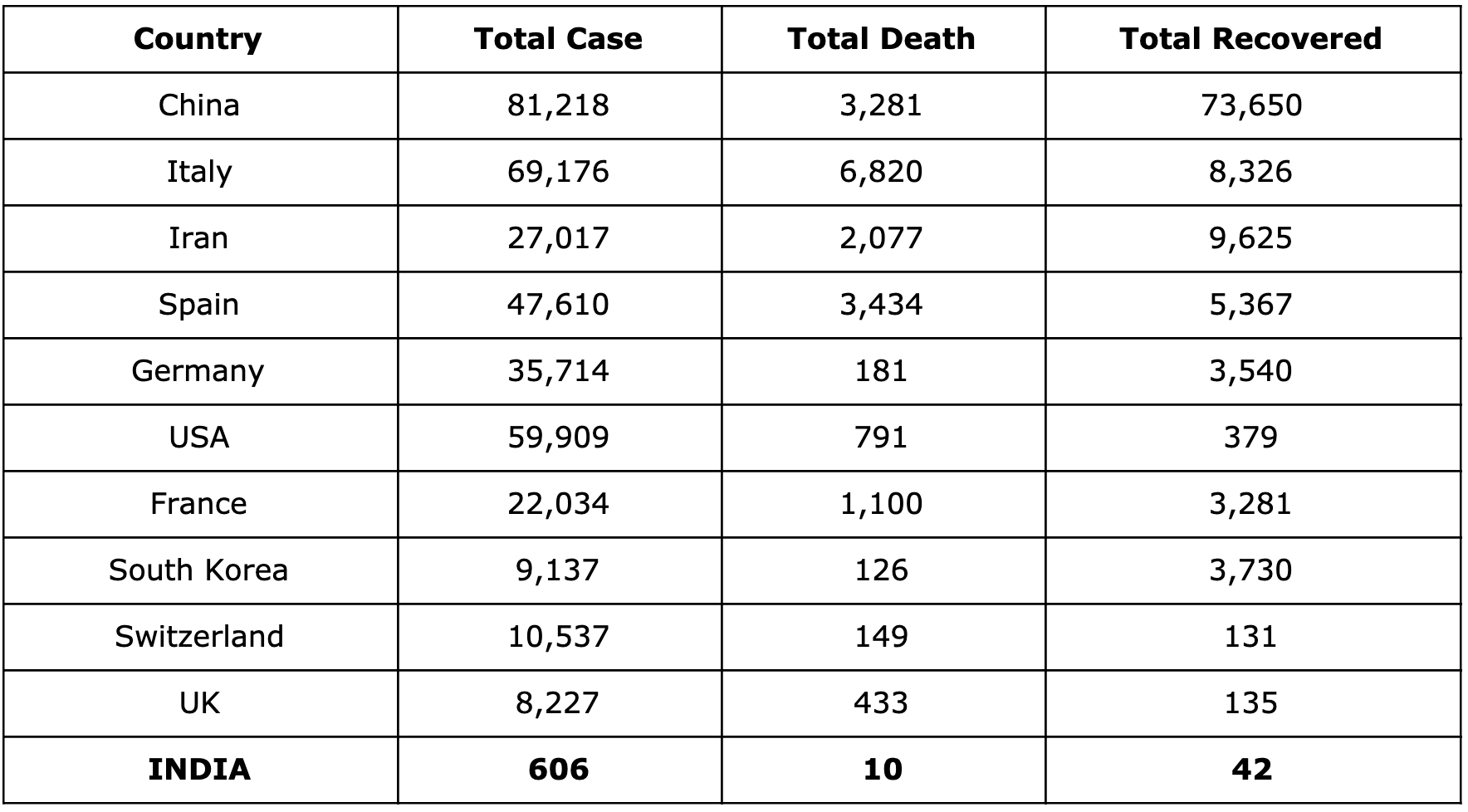

So far Italy is the worst affected & other most affected countries are China,Iran,Spain,Germany, USA,France,South Korea,Switzerland & UK.

Below is the table for reference (Data Source Worldometer as on 25.03.2020)

Proud to say that Steps taken by GOI is highly appreciated by other nations & WHO.

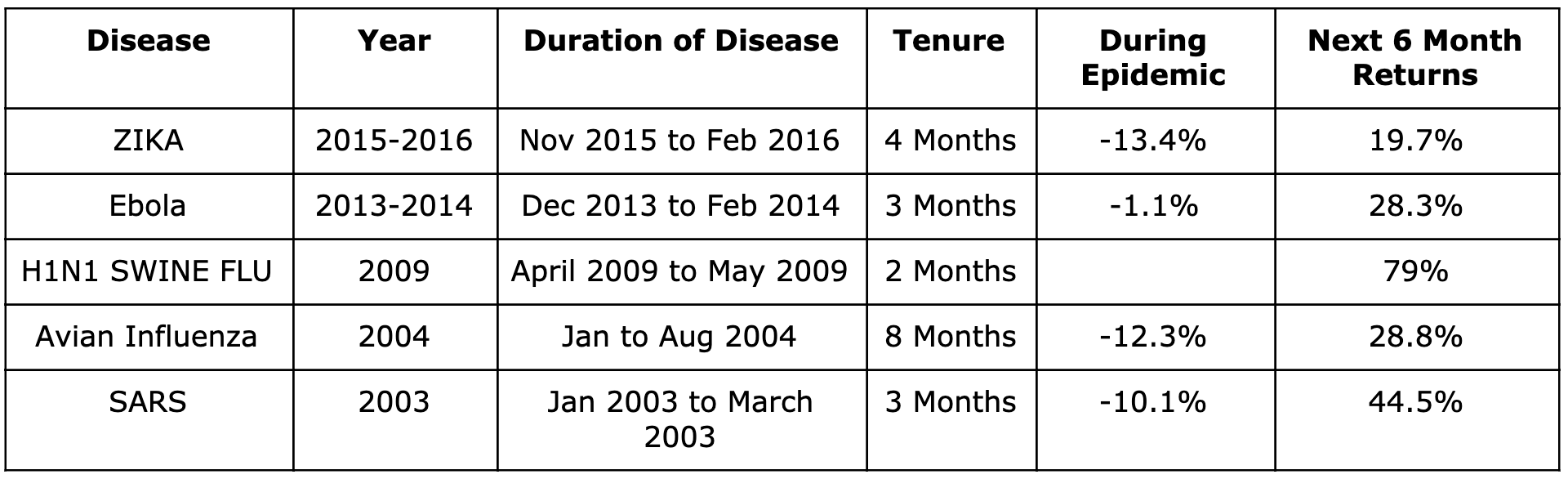

Some of the epidemic & Equity market reaction in last few years are as follows

Now, if we talk about Investing money,

One must not hesitate to invest money now, as Warren Buffet says One should be greedy when others are fearful.

My suggestion and making you believe in the equity market might not attract you at this time,I appear to be a foolish person to you who is asking to invest or to remain invested .

What I believe is that we always look and wait for the opportunity to buy at discounted rates or low levels in the market but as and when opportunity comes we back out & fear to invest.

Once the Corona fear fades out we will witness sharp recovery in Equity Markets.

Believe in Growth story of Indian economy, impact of coronavirus would surely affect the growth rate but cannot put brakes on growth. Long term growth story of India is Intact.

We are currently $ 2.94 Trillion Economy 3rd largest Economy juss behind USA & CHINA.

IF we look at the World GDP its now $ 91.98 Trillion & Growth rate is around 2.5 %.

INDIA is the fastest growing economy in the world with a nominal GDP of $ 2.94 Trillion though growth rate has come down to 4.7 % in recent quarter but it is strongly believed India will pick up the growth rate in coming years.

Further,

Do you ever think……???

The world is gonna come to an end ?

There will be nothing down the line 5-10-15-20 years from now onwards ?

All companies & Factories will be shut down ?

No school,colleges,theater,Cinemas,Mall,Restaurants e.t.c will be opened ?

No Railways, Airlines will be operated ?

If not, then do take advanatge of SALE available in stock prices, use SIP mode to participate or Increase your equity allocation.

We all want our Echocardiogram Graph not to be in a linear way. It should be in up & down movement to stay alive.

Same like Sensex & Nifty, they too cannot remain in linear way to move.there will be ups and down.

Market has seen this kind of correction in the past also and we are witnessing again though reason is different. Saying it doesn’t mean that concern about corona is less or Ignored.

Correction in market is the part of it, before making life time high in 2008 market has witnessed 35 to 40 % correction in MIdcap Segment and we all know what happened after that.Index touched life time high in 2008.

We are very well placed to achieve $5,$7,$10 Trillion economy.Some Major point of macro levels to support are as follows:-

1. Economy Heading to $5 Trillion

2. Per Capita Income is above $2000

3. Market Cap to GDP ratio is 48% ( suggest market is oversold it went high as

158% in Jan 2007 and low as 45% in 2003)

Risk To reward ratio is strongly favorable, Market has overcome from so many storms in the past…. This shall too pass….

Lastly, Save Yourself & DO Save For Yourself.

Best wishes

Pankaj Pancharia

(Please feel free to connect support@fundspru.com